Press Release

|January 15,2025Private New Home Sales Plunged By 92% MOM In December 2024 Amid A Drought Of New Project Launches And A High Base In November

Share this article:

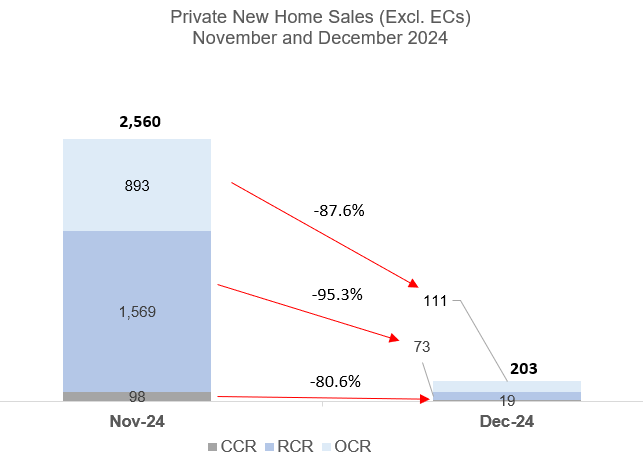

Following the sizzling sales in November, new home sales fizzled out and fell by 92% in December to 203 units (ex. EC) from the 2,560 units transacted in the previous month. The slump in developers' sales was expected as there were no fresh project launches in December, after an unprecedented deluge of launches in November. The 203 new units sold in December represent the lowest monthly sales in 10 months, since 153 units were transacted in February 2024. On a year-on-year basis, developers' sales were about 50% higher than the 135 units shifted in December 2023.

Developers placed only 20 new units (ex. EC) for sale in December, all from The Myst which was launched for sale in July 2023. This is drastically lower than the bumper 2,871 units released for sale in November. Based on monthly data tracked by PropNex starting from 2009, the 20 units launched in December 2024 is the lowest on record.

Source: PropNex Research, URA (15 January 2024)

Shorn of new launches, all three sub-markets witnessed a decline in sales in December from November. The Outside Central Region (OCR) led monthly sales, with 111 units (ex. EC) sold in December - down sharply by about 88% from 893 units transacted in the previous month. The top-selling OCR projects in December were Hillock Green (see Table 2) which sold 19 units at a median price of $2,278 psf, The Myst which moved 17 units at a median price of $2,080 psf, and Chuan Park which transacted 11 units at a median price of $2,657 psf. Home sales in the OCR are projected to be relatively lively in January as freehold development, the 113-unit Bagnall Haus (next to upcoming Sungei Bedok MRT interchange station) is slated to be launched on 18 January.

The Rest of Central Region (RCR) saw 73 new homes sold during the month, also markedly lower than the 1,569 units shifted in November, where projects such as Emerald of Katong and Nava Grove boosted sales. In December, the most popular RCR projects included The Continuum which sold 15 units at a median price of $2,864 psf, and Pinetree Hill where 11 units changed hands at a median price of $2,543 psf. Developers' sales in the RCR are also expected to rise in January, with the upcoming launch of the 777-unit The Orie in Toa Payoh.

Over in the Core Central Region (CCR), developers sold 19 new units in December - moderating from the 98 units shifted in the previous month. The CCR project that posted the highest sales during the month was The Collective at One Sophia which moved 9 units at a median price of $2,758 psf. New private home sales in the CCR have been mostly tepid, amid limited new CCR project launches since the tightening of the additional buyer's stamp duty (ABSD) measure in April 2023. That said, CCR sales are likely to pick up in January, with One Bernam reportedly selling more units.

Over in the EC segment, sales fell by 49% to 170 units in December from 334 units in November. The best-selling EC project was Novo Place in Tengah which sold 158 units at a median price of $1,647 psf in December, when the project was opened to second-timer buyers a month after it was launched. Overall, Novo Place EC has transacted 445 out of its 504 units (or 88%) since it hit the market in November 2024. Based on URA's data, there were 160 unsold new EC units as at the end of December. This tight supply of unsold stock bodes well for the upcoming EC project, Aurelle of Tampines which will offer 760 new EC units.

Ms Wong Siew Ying, Head of Research & Content, PropNex Realty said:

"Developers' sales lost steam in December as there were no new projects being launched. Including the 203 units (ex. EC) sold in December, developers shifted an estimated 3,501 new private homes (ex. EC) in Q4 2024 - taking the full year new home sales to around 6,550 units, which is 2% higher than the 6,421 units sold in 2023.

According to URA Realis caveat data, about 82% of new private homes (ex. EC) sold in December were priced at below $3 million, relatively close to the 84% proportion in November (see Table 1). In particular, 51% of the new homes were transacted at the pricing sweet-spot of $1.5 million to $2.5 million in December - slightly lower than 56% in November. Despite the pick-up in market sentiment of late, buyers remain price sensitive and we expect homes priced below $3 million to generally fit the budget of owner-occupiers who are purchasing the property for own stay.

Meanwhile, new private homes spanning 1,000 to 1,200 sq ft in size made up a bigger proportion of sales in December at 24% of the month's transactions (see Table 1), as buyers picked up properties in existing launches, including at The Myst, Hillock Green, The Continuum, and Sceneca Residence. In contrast, nearly 40% of the transactions in November were for smaller units sized between 600 and 800 sq ft - mostly at new launches Chuan Park, Emerald of Katong, and Nava Grove.

Table 1: Proportion of overall private new home sales (ex. EC) by size and price range

| Floor area (sq ft) | Nov-24 | Dec-24 | Price range | Nov-24 | Dec-24 |

| 400-600 | 6.7% | 8.3% | $1 mil to < $1.5 mil | 6.9% | 8.3% |

| 600-800 | 39.6% | 23.3% | $1.5 mil to < $2 mil | 35.6% | 18.4% |

| 800-1,000 | 21.6% | 15.0% | $2 mil to < $2.5 mil | 20.6% | 32.5% |

| 1,000-1,200 | 17.0% | 24.3% | $2.5 mil < $3 mil | 21.3% | 22.3% |

| 1,200-1,400 | 10.4% | 15.0% | $3 mil to < $3.5 mil | 10.2% | 6.8% |

| 1,400-1,600 | 3.2% | 6.3% | $3.5 mil to < $4 mil | 3.7% | 4.4% |

| 1,600-1,800 | 1.1% | 3.4% | $4 mil to < $5 mil | 1.2% | 3.4% |

| 1,800 and above | 0.5% | 4.4% | $5 mil and above | 0.4% | 3.9% |

100% | 100% | 100% | 100% |

The median transacted price of non-landed private new homes (ex. EC) sold in December was $2.27 million, a shade lower than $2.29 million in the previous month, based on caveats lodged. Meanwhile, the median price of new EC units sold was $1.56 million in November, compared with $1.47 million in December.

In 2025, quantum play will remain a key strategy for developers as price quantum is ultimately what matters most to homebuyers and investors when they assess their ability to get financing, determine stamp duties payable, as well as to evaluate potential rental yield. Furthermore, with the rule on harmonisation of GFA definitions, it may not be as straight-forward when comparing $PSF prices across various projects launched at different time. It is likely that projects affected by the GFA harmonisation rule will have a higher $PSF price, but the price quantum may not be necessarily be higher than another project, which is not affected by the GFA harmonisation guidelines. This is something that prospective buyers will need to note when comparing their options.

Excluding EC, PropNex estimates that more than 11,000 new units (from 30 projects) could potentially be launched in 2025 - compared with about 6,300 units (ex. EC) from 22 projects that hit the market in 2024. With more launches expected in 2025, PropNex projects that developers' sales may rise to 8,000 to 9,000 units (ex. EC) this year. Apart from the launch pipeline, the positive economic outlook and easing interest rates could also serve as catalysts to shore up market confidence.

New home sales in 2025 will kick off with the launch of the 777-unit The Orie in the RCR and 113-unit Bagnall Haus in OCR on 18 January. The Orie reportedly drew 8,000 visitors on the first three days of its preview, while Bagnall Haus saw 1,500 visitors on the first weekend of its preview. Meanwhile, several new projects including Lentor Central Residences (477 units), ELTA (501 units), Parktown Residence (1,193 units), and Aurelle of Tampines EC (760 EC units) may potentially be rolled out in the coming months. In view of these diverse launches, we expect to see a stronger start to developers' sales in 2025 compared with 2024."

Table 2: Top-Selling Private Residential Projects (ex. EC) in December 2024

S/N | Project | Region | Units sold in Dec 2024 | Median price in Dec 2024 ($PSF) |

1 | HILLOCK GREEN | OCR | 19 | $2,278 |

2 | THE MYST | OCR | 17 | $2,080 |

3 | THE CONTINUUM | RCR | 15 | $2,864 |

4 | PINETREE HILL | RCR | 11 | $2,543 |

5 | CHUAN PARK | OCR | 11 | $2,657 |

6 | SORA | OCR | 10 | $2,198 |

7 | THE COLLECTIVE AT ONE SOPHIA | CCR | 9 | $2,758 |

8 | HILLHAVEN | OCR | 9 | $2,175 |

9 | LENTORIA | OCR | 7 | $2,291 |

10 | NAVA GROVE | RCR | 7 | $2,612 |